The Evolution of UAE Banking: An Overview

Over the past decade, the UAE has transformed from a regional financial center into a global powerhouse of innovation and diversity in banking. Today, the industry is characterized by a blend of long-established institutions and emerging digital technology that is redefining what banking means in the 21st century. This transformation is driven by increased investments in technology, regulatory reforms aimed at enhancing transparency and security, and a growing demand for personalized financial products and services.

Banks in the UAE now face the dual challenge of preserving a rich heritage of trust and stability while embracing the digital revolution that demands speed, efficiency, and innovative service delivery. In this context, the Best Banks in UAE are those that strike the perfect balance between tradition and transformation, ensuring they remain resilient in the face of economic fluctuations while also offering cutting-edge digital experiences.

Top 10 Best Banks in UAE

Here is a list of the top 10 and popular banks operating in the UAE:

Market Dynamics and the Importance of Digital Transformation

The UAE’s banking sector is undergoing an unprecedented wave of digital transformation. Customers, ranging from individual account holders to multinational corporations, expect seamless, multichannel banking experiences. In response, many leading banks are investing heavily in artificial intelligence, block chain technologies, and mobile platforms to meet these expectations.

Digital transformation is not just about technology; it’s also about improving customer service and operational efficiency. For instance, banks are now using advanced data analytics to tailor services to individual customer needs, from personalized financial advice to dynamic risk assessments. In this digital age, the best banks in UAE are those that can offer secure, intuitive, and flexible solutions that keep pace with global innovations.

Moreover, the economic recovery post-pandemic and fluctuating oil prices have further accelerated the need for digital agility. The integration of fin tech innovations into traditional banking operations has redefined how customers interact with their financial institutions. The banks that have embraced these changes are not only improving their efficiency but are also attracting a younger clientele.

Benefits of the Best Bank in UAE for Expats:

Before opening a bank account in the UAE, it’s essential to consider your financial needs and compare the benefits offered by different banks. The right bank can provide expats with convenience, security, and financial flexibility. Key benefits include:

-

Salary Transfers – Employers in the UAE typically transfer salaries directly to employees’ bank accounts, ensuring timely and secure payments.

-

Secure Money Management – Instead of handling cash, you can safely store funds in your account and transfer money locally and internationally using bank services.

-

Cheque Book and Debit/Credit Cards – Banks issue cheque books for payments and offer debit or credit cards for everyday transactions and international use.

-

Online Shopping and Bill Payments – Expats can pay utility bills, mobile recharges, and other expenses easily through online banking or mobile banking apps.

-

Internet and Mobile Banking – Most UAE banks provide user-friendly digital banking platforms, allowing expats to manage accounts, make transfers, and monitor transactions anytime.

-

Savings and Investment Options – Banks offer savings accounts with competitive interest rates, fixed deposits, and investment solutions to help expats grow their wealth while in the UAE.

-

Exclusive Benefits for Expats – Some banks provide tailored benefits such as free remittances to home countries, preferential exchange rates, and discounts on financial products like loans and credit cards.

Choosing a reputable bank with expat-friendly features can make financial management in the UAE smoother and more efficient. Always compare fees, services, and eligibility requirements before opening an account.

Also Check: Best Credit Card in UAE

How to Open a Bank Account in the UAE

Opening a bank account in the UAE is a straightforward process, and many banks now offer the option to apply online. While visiting a branch may still be required for getting loans or other business account purposes, but almost all banks now allow customers to complete the process digitally by submitting the necessary documents via email, the bank’s website, or through mobile app.

Required Documents to Open a Bank Account in the UAE

To open a personal account, most banks require the following:

- Valid Emirates ID & Residence Visa– Proof of UAE residency and identification.

- Valid Passport Copy – Minimum passport validity is 3 to 6 months.

- NOC or Salary Certificate from Employer – Required for salary transfer accounts to verify employment and income.

Additional documents may be required depending on the bank, account type, and whether the applicant is a resident or a non-resident. Non-residents often need to provide proof of address, a reference letter from their home bank, and evidence of financial stability.

Best Banks in UAE: Our Top Picks

Emirates NBD and Dubai Islamic Bank are among the top banks in the UAE, known for their fast online banking services, extensive branch networks, and widespread ATM access. Below is the list of top 10 banks in the UAE to help you choose the best option:

1: Emirates NBD

Emirates NBD also known as National Bank of Dubai provides a comprehensive banking solution designed to meet the financial needs of individuals in the UAE. Whether you’re looking for a convenient way to manage your salary, make transactions, or access banking services internationally, this account offers flexibility and ease of use.

Customers can open an account instantly using Emirates NBD mobile app or visa website in either AED or USD, giving them the option to handle finances in their preferred currency. The bank provides a range of digital banking services, including online and phone banking, downloading statement, allowing customers to manage their accounts anytime and from anywhere. Additionally, with access to over 600 ATMs across UAE, withdrawing cash and making transactions is always convenient. Schedule of Charges can be found here

| Fee Type | Amount (AED) |

|---|---|

| Account Maintenance Fee | 25 AED (if monthly average balance falls below AED 3,000) |

| Debit Card & Cheque Book Fee | First Debit Card and Cheque book is free; subsequent book and card renewals are at AED 26.25 |

| Account Opening Fee | Free |

| Local Transfer | Free |

| Account Closure | AED 105 (only if closing within 6 months) |

Emirates NBD Current Accounts:

- Current Account: Salaried, non-salaried and self-employed individuals can apply for this Emirates NBD standard current account, the account holder will get free Cheque book and free debit card (first time only), flexibility of opening an account in a foreign currency including Euro, USD, GBP etc, up to 10 free teller transactions a month. A minimum balance and salary of 3,000 Dirhams is required for this account.

- Islamic Current Account: Emirates NBD’s Shari’ah compliant current account allow account holder save up to 4000 AED with debit card deals. This account is based on the principal of ‘Qard Hassan’ with no profit payments comes with free debit card and cheque book for the first time. AED 3000 should be maintain in account to avoid deduction of 25 AED per month.

- Special Current Account: Emirates NBD current account that earns interest daily, simply transfer salary and earn interest in multiple currencies with this special checking account which is exclusively designed for employees of the company. No account opening fee, it can be open in AED and USD with free cheque book and 10 free teller transactions a month.

- Gold Investment Account: This account is all about investment in gold through Emirates NBD. No Cheque book, No Debit card, No withdrawals and fund transfers. You can start investing in Gold from AED 500.

Emirates NBD Saving Accounts:

Emirates NBD offer 12 types of saving accounts, Let’s explore some of them.

- Saving Account: Interest rate up to 0.20% p.a, comes with free debit card but no cheque book.

- Plus Saver Account: Available in AED and USA with Minimum balance of AED 3,000.

- Mudaraba Saving Account: An Islamic account based on ethical profit sharing, the minimum maintaining balance is AED 3,000 available in AED and USD.

To know more about Emirates NBD Account opening online, features and benefits, click here.

Benefits of Banking with Emirates NBD:

- Multiple Currency Account – Flexibility to manage funds in multiple currencies.

- Direct Remit – 60 seconds transfers with no fees, Free round-the-clock transfers to home country in 1 minute using Mobile or Online Banking including UK, India, Pakistan, Sri Lanka, Philippines and Egypt.

- Card less Withdrawals – Forgot your card? no problem, you can still withdraw cash using your mobile, simply visit any Emirates NBD ATM and choose ‘Card-less Withdrawal’ to access your money. You will need the Emirates NBD Mobile app to use this feature.

- Cheque Book Facility – Convenient for payments and financial transactions.

- mePay – With mePay, you can transfer money easily using mobile banking. All you need is just a mobile number, no account or IBAN is require. mePay transfer works on other banks too.

- Free International ATM/Debit Card – A convenient alternative to cash. You can choose from 11 different types of debit cards.

- Monthly Account Statements – Track transactions with ease, you can get free monthly account statement in your mail.

- Bill Payment Services – Pay utility and other bills conveniently including telecommunication, utilities, credit cards, RTA, property, airlines, Dubai government, ICP UAE, GDRFA and other payment options.

- Online and Phone Banking – Manage accounts anytime, anywhere.

- Extensive ATM Network – Over 600 ATMs across UAE for quick access to cash.

For more details, visit the Emirates NBD website.

2. Dubai Islamic Bank (DIB)

DIB Current Accounts:

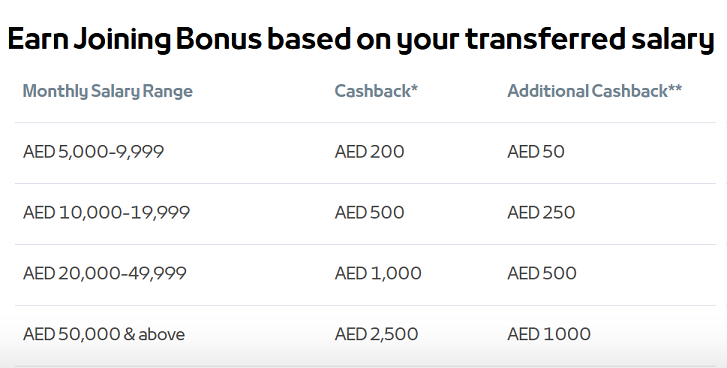

- DIB Xtra Salary Transfer Account – Best bank account for salary transfer, Zero balance account by DIB, Free online international transfers, Exclusive benefits on a suite of DIB Cards- EK Miles, EK Silver Membership, Valet Parking, Airport Lounge Access, up to 16,000 AED Guaranteed Joining Bonus, Personal finance up to 5 Million AED.

- Al Islami Current Account – Free mobile banking, Free utility bill payments, Free electronic banking, Free account statements, up to 75,000 AED Daily Cash Withdrawal with a DIB Debit Card.

- Johara Current Account – Free mobile and electronic banking, online payment of bills.

- Al Islami 2-in-1 Account – Free Mobile banking, Electronic banking, Expected profit earnings, free first cheque book, free bill payment facility.

DIB Saving Accounts:

- Al Islami E-Savings Account – This DIB saving account is only for existing dib account holders. You can open this account online.

- Al Islami Savings Account – Available for minors with facility of electronic banking. This DIB Al Islami Savings Account comes with bill payment facility and gives expats the opportunity to earn even more in AED or USD.

- Shatir Savings Account – This bank account is for kids, comes with no minimum balance and no maintenance fee. It’s free to open under your kids name that comes with personalized card for them.

What Customers Get with DIB UAE:

- A free first cheque book for convenient transactions.

- A free debit card with 5 years validity for easy payments.

- Free cash, cheque withdrawal, and deposit services at DIB ATMs and branches

- Free mobile banking access for making online payments and fund transfers

- Free monthly e-statements for easy tracking of transactions

- Free Salik recharge facility to top up road toll accounts without extra charges

- Free bill payment services for Etisalat, Du, DEWA, SEWA, and FEWA

- Live chat option for quick and efficient customer support.

For more details or to open an account, visit DIB’s official website.

3. Liv (By Emirates NBD)

Liv is a digital-only bank with no offices and branches owned by Emirates NBD, offering a free UAE bank account with a fully online application process. No NOC or salary certificate is required, and there is no need to visit a branch. Everything is done digitally.

- Amount to Open Account: 0 AED

- Monthly Average Balance Requirement: 2,500 AED

- Fee if Balance Not Maintained: 15 AED per month

- Early Account Closure Fee: 50 AED

What Customers Get with Liv

- Instant digital current or savings account

- Debit card for worldwide payments

- Mobile app for payment transfers and pay bills

- Cash withdrawal at all UAE ATMs

- 24/7 customer support with live chat, Whatsapp and call center

- Exclusive discounts on online shopping, dining, and entertainment

- 2.5% interest upfront on fixed deposits

4: ADCB (Abu Dhabi Commercial Bank)

Abu Dhabi Commercial Bank (ADCB) offers a personal banking account designed to provide customers with financial flexibility, rewards, and essential banking services. With a required monthly average balance of 5,000 AED, this account ensures access to exclusive benefits while maintaining straightforward banking solutions. Customers who do not meet the balance requirement will be charged a 25 AED monthly fee.

| Fee Type | Details |

|---|---|

| Minimum Monthly Salary or Balance | 5,000 AED |

| Account Opening Fee | Free |

| Fees for e-statement | Free |

| Fees for First Cheque Book | Free |

| First Debit Card Fee | Free |

| Duplicate Statement Fee | AED 25. |

| Deduction for not maintaining Balance | AED 25. |

ADBC Current Account designed for people working in the UAE, It offers online and mobile banking with everyday utility payments and transfers. To know more about ADCB account types and benefits, check this link

With a focus on integrating sustainable practices into its operations, Bank ADCB is working to align its services with global standards of corporate responsibility. For customers looking for a bank that not only delivers easy digital solutions but also champions ethical practices, ADCB is frequently listed among the best banks in UAE.

Download the Official ABCB App here:

To open an ADCB account, applicants must provide a salary certificate as proof of income. This ensures eligibility and enables customers to enjoy a range of services, including free ADCB Online banking tools, secure transactions, and additional perks such as rewards and special offers.

ADCB Benefits

- Rewards and Offers – Enjoy exclusive promotions and loyalty benefits.

- First Cheque Book for Free – Issue cheques conveniently at no initial cost.

- Free Debit Card – Make payments and withdraw cash without additional fees.

- Free E-Statements – Receive digital account statements for easy tracking.

- ADCB Online Banking – Easy to use ADCB App and ADCB e banking website.

For more details, visit the ADCB website.

5: FAB (First Abu Dhabi Bank)

First Abu Dhabi Bank (FAB), formerly known as the National Bank of Abu Dhabi (NBAD), is one of the UAE’s leading financial institutions, offering a range of banking services tailored to individuals and businesses. With a strong presence both locally and internationally, FAB Abu Dhabi bank provides customers with secure and flexible banking solutions.

To open an account in Bank FAB, a minimum deposit of 3,000 AED is required, and customers must maintain a monthly average balance of 3,000 AED. Those who fail to meet this balance will be subject to a 25 AED monthly fee. The bank also provides a generous daily cash withdrawal limit of 15,000 AED, allowing customers easy access to their funds. Additionally, a salary certificate is mandatory to complete the account credit card issuing process.

| Fee Type | Details |

|---|---|

| Account Opening Fee | Free |

| FAB Standard Debit Card Limit | AED 15,000 |

| FAB Platinum Debit Card Limit | AED 20,000 |

| Minimum Salary/Deposit | AED 3,000 |

| First Debit Card | Free |

| First Cheque Book | Free |

| Monthly Statement or e-statement | Free |

Download the Official FAB Mobile Banking App:

FAB’s diverse portfolio caters to both retail and corporate clients, offering everything from personal banking services to complex investment solutions. The institution’s strong balance sheet and robust risk management strategies have earned it a reputation for stability and reliability. For customers who prioritize innovation coupled with financial strength, FAB banking remains a top contender among the best banks in UAE for expats.

FAB Accounts:

- Personal Current Account: A current account specially designed for UAE Residents both salaried and non-salaried. This FAB Bank account comes with free Fab Mastercard debit card, free cheque book, free lounge access at selected airports.

- FAB One Account: This UAE Bank account is expats favorite as it comes with no minimum balance charges, earns your rewards on your purchases. Account can be opened online through FAB Mobile App, after successful account opening, customer will get Free FAB Platinum Debit Card with free lounge access at selected airports in the UAE. Minimum monthly salary or initial deposit is AED 10,000.

- Other FAB accounts are Elite Current Account, Personal Savings account and iSave Account.

What Customers Get with FAB

- First cheque book for free

- Free cash, cheque withdrawal, and deposit services

- Free FAB Mastercard Debit Card

- Platinum account holders receive free lounge access at 25 airports globally

To apply for FAB account or to know more, visit the FAB website.

6: RAK Bank (Ras Al Khaimah Bank)

RAK Bank, the first Ras Al Khaimah Bank provides a convenient and accessible banking experience for individuals looking for a simple yet feature-packed current account. To maintain an account, customers are required to keep a monthly average balance of 3,000 AED, with a 25 AED monthly fee applied if the balance falls below this threshold and AED 5,000 Monthly salary or above. Additionally, customers can also sign up for the salary transfer account during the account opening process.

| Fee Type | Details |

|---|---|

| Annual Fee | No annual or joining fee. |

| Account Opening Fee | Free |

| Minimum Balance | AED 3000 |

| Account Closing Fee | AED 100 (If closing within 6 months) |

| New Cheque Book Order | AED 50 |

| Card Replacement Fee | AED 75. |

| Stamped Statement Fee | AED 45 per statement. |

| Returned Cheque Charge | AED 100. |

| International Transaction Fee | 2% of the transaction amount |

Download the Official Rak Bank App:

RAK Bank Accounts:

- Current Account: Rak Bank current account holders to get rakbank titanium debit master card for free with an option to open joint account for two which is a plus point. To apply for RAK BANK account, you must be 21 years old or above. Your Minimum monthly salary should not less than 3000 AED.

- Saving Account: Rak Bank called this account, the best saving account in the UAE which is for both UAE Residents and non-residents. This saving account allow holder to save with 0.2% p.a interest with benefit of no minimum balance for 3 months. The minimum monthly average balance for this account is 3000 AED.

- Business Account: RAK Bank Business account are among the best in the UAE with 3 types of accounts including Business current account, business elite account and business call account.

To know more about RAK Bank Deposit Accounts, click here.

Furthermore, RAKBANK’s strategic focus on small and medium-sized enterprises (SMEs) has reinforced its position as a bank that understands the unique challenges of growing businesses. Its robust portfolio of SME-friendly products, combined with its digital efficiency, makes RAKBANK a critical player among the best banks in UAE.

What Customers Get with RAK Bank

- Account available in AED, USD, EUR, and GBP

- Free cheque book upon account opening

- Free RAKBANK Debit Mastercard

- Option to get Join account and joint cards

- Card less payment and withdrawal

- Free monthly e-statement

- Earn Salam Points on transactions

For RAK BANK account opening, visit the RAK Bank website.

7: ADIB (Abu Dhabi Islamic Bank)

ADIB is a leading Islamic bank in the UAE, offering Sharia-compliant banking services designed to meet the needs of individuals and businesses. In ADIB Bank UAE, the Customers must maintain a monthly average balance of 3,000 AED, with a 25 AED fee applied if the balance requirement is not met. A salary certificate is required to open the account. Unlike many other banks, ADIB does not charge a monthly fee for maintaining an account. For this reason among many, ADIB is considered as one of the best banks in UAE.

Note: Please note that ADIB Abu Dhabi fees may vary depending on the specific ADIB credit card product. For the most accurate and up-to-date information, refer to the official ADIB Covered Cards Schedule of Charges and Fees.

ADIB Accounts:

- Current Account: ADIB current account offers the flexibility to apply for debit card, cheque books, pay bills, transfer salary, funds and withdraw cash without any additional charges across 500 ATM’s in the UAE. ADIB Abu Dhabi Islamic Bank Current account may be opened for customers with minimum salary of AED 5,000.

- Saving Account: The bank Abu Dhabi Islamic saving account lets you safely access your savings in time of need. The account holder gets free unlimited teller transactions at 60 plus branches in the UAE with free visa debit card and cheque book.

ADIB Business and financing options can be found here.

Download the Official ABID Banking App:

What Customers Get with ADIB Islamic Bank:

- 700 ATMs and 80 branches across the UAE

- Account available in different currencies

- Free cheque book and Visa debit card

- Free mobile banking app for transfers, bill payments, and more

- Free monthly e-statement

- 24-hour banking services

- No rewards on current accounts

For more details, visit the ADIB website.

8: Mashreq Bank

Mashreq Bank is one of the UAE’s oldest and most well-established financial institutions, offering a range of banking solutions to individuals, kids and businesses. Mashreq bank network is working in India, Pakistan, Egypt, UK, USA, Hong Kong, China, Nepal, Bangladesh and all GCC Countries.

Mashreq Neo is among is the most popular account being opened by residents in the UAE. The bank requires a monthly average balance of 3,000 AED, with a 25 AED penalty for not maintaining this balance. To open an account, customers must be at least 18 years old.

Mashreq Bank Accounts:

- NEO Current Account: The only account that gives cashback of up to AED 5,000 on account opening. This limited time offer gives you up to AED 3500 for just salary transfer and up to AED 1000 cash back for transferring money to your friends and AED 300 for International transactions. checkout the mashreq bank cashback detail below. To get this account, your monthly income should be AED 5,000.

- NEO Saving Account: 0.15% p.a interest rate, free visa debti card. To open Mashreq NEO account, you just need an Emirates ID, your account can be opened in 2 minutes. Minimum monthly balance to maintain is AED 5,000.

- NEO NXT Account: Specially designed for Kids residing in the UAE with their parents. Parents can simply log in to their Mashreq Mobile App and click on the ‘Open NEO NXT Account’ button to open a NEO NXT account for their children within 5 minutes.

Charges may be variable. Please consult Schedule of Charges.

Mashreq Bank stands out as one of the most innovative financial institutions in the UAE. Known for its agile approach and customer-centric innovation, Mashreq Bank has successfully reinvented itself in the digital era. As one of the best banks in UAE, Mashreq Bank’s advanced online platforms and mobile applications are designed to offer a user-friendly experience that simplifies complex financial tasks.

Download the Mashreq Bank Official App:

Mashreq’s strategy includes partnerships with fintech startups to develop new digital products, thereby keeping it at the cutting edge of banking technology. This openness to collaboration and innovation has made Al Mashreq bank a favorite among tech-savvy consumers who seek both traditional banking services and futuristic digital solutions. This characteristic is distinctive of the best banks in UAE.

Benefits of Al Mashreq Bank

- Free first cheque book

- Free Visa debit card

- Free mobile and online banking access

- Free monthly e-statement

- Free tele-banking services

- Mobile banking app for seamless transactions

- Cashback options on salary and fund transfers

- Account for kids

For more details, visit the Mashreq Bank website.

9: Commercial Bank of Dubai (CBD)

Commercial Bank of Dubai (CBD Bank) provides a current account with a monthly average balance requirement of 5,000 AED. Customers who fail to meet this balance must pay a 105 AED monthly fee. The daily cash withdrawal limit is 10,000 AED, and an account closure fee of 100 AED applies (if closed within 6 months). The account is only available to individuals aged 18 years or older.

Features of CBD Current Account:

- Thousands of discounts through CBD mobile app.

- Foreign currency account opening

- Instant remittances to India, Pakistan, Bangladesh and Philippines

- Free Debit Card

- Daily cash deposit limit via ATM is AED 10,000

Read the detailed Fee & Charges information for CBD Bank from Here.

What Customers Get with CBD

- Account available in USD, GBP, and EUR

- Earn CBD Reward Points

- Free first cheque book

- Free debit card

- Monthly e-statement with cheque images

- Free online and mobile banking services

- Personal overdraft facility

- Earn Attijari Rewards Points

- Wide range of Business account packages

For more details, visit the CBD website.

10: Emirates Islamic Bank

Emirates Islamic Bank (EI Bank) is considered one of the best Islamic bank in the UAE, provides current account for expats with no account opening fee, making it an attractive option for those looking to start banking without initial costs. Customers must maintain a monthly average balance of 3,000 AED or salary transfer of 5,000 AED, failing which a 25 AED fee is charged.

Plus point is that an account holder of Emirates Islamic Bank can use Emirates NBD ATM, Cheques and local transfers without any additional charges because Emirates Islamic Bank is also owned by Emirates NBD.

Benefits of Emirates Islamic Current Account:

- No minimum balance charges if salary is transferred.

- Free Debit card.

- Free Chequ Book.

- Personal checking facilities for UAE residents.

- Free online banking.

- Free Phone banking.

- SMS updates for card and transfer transactions.

- Available in Multiple Currencies including USD, GBP, Euro, Yen, Canadian Dollar and all GCC Currencies.

To open an account or to know more, visit the Emirates Islamic Website.

Terms & Conditions for Opening a Bank Account in the UAE

Most banks in the UAE require an initial deposit of 3,000 to 5,000 AED to open an account or ask you to maintain the same amount as a monthly average balance.

If you fail to meet the minimum balance or salary transfer criteria, banks will charge a 15 to 25 AED monthly fee. This applies if your account does not receive the required salary transfer or if the minimum balance isn’t maintained.

Some banks, such as Standard Chartered, have higher requirements, demanding up to 10,000 AED to open an account. This is important for expats earning an average salary in the UAE who need a suitable banking option. It is important to peruse through the given list of Best Banks in UAE to make your choice and secure your finances.

Digital Banks in the UAE:

Liv and Mashreq Neo are both the digital banks operating without branches in the UAE. Both banks are offering similar benefits like other traditional banks such as debit or credit cards, loans, online banking facility, funds transfer, utility payments and much more through just an mobile app.

Which bank is best in the UAE, other than mentioned in above list?

Sharjah Islamic Bank, Standard Chartered and HSBC are also among the best banks for residents but as per banks data, the top 10 banks mentioned above are the most popular banks in the UAE. They offer more benefits, branches and hundreds of ATM’s across the UAE.

How to save money in the UAE using Bank Account?

Living in UAE might be expensive but there are many ways to save money, we are sharing some of the expert tips below:

- Choose the right bank: Some banks in the UAE charge monthly fees, ATM withdrawal fees, deduct on International transfers or have high minimum balance requirements. Opt for banks with lower fees or accounts that suit your lifestyle.

- Avoid foreign currency conversion fees: If you’re transferring money to your home country or paying for something in foreign currency, look for cards that offer no foreign exchange fees or open account that allow free remittances to expat countries such as RAK Bank and Emirates NBD.

- Use ATMs of your Banks only: Some banks charge a fee of 1 or 2 AED per transaction for withdrawing money from ATMs that are not within their network. Stick to ATMs operated by your bank to avoid unnecessary charges.

- Choose free or low-fee accounts: Look for banks that offer zero-fee accounts or waive fees when you maintain a minimum balance. CBD bank is currently deducting 105 AED for not maintaining balance which is quite high as compare to other banks in the UAE.

- Bank Cashback: Many banks in the UAE offer sign-up bonuses, cashback offers, or reward points when you open an account or transfer salary to them such as Mashreq NEO. Keep an eye out for these promotions and cashbacks to maximize your savings.

FAQs

1. Can I open a bank account in the UAE without a minimum balance requirement?

Currently no bank is offering minimum balance (zero balance account) in the UAE. Earlier, CBD and LIV were not deducting for low balance but now they are charging 15 AED by Liv and 105 AED by CBD for not maintaining the minimum balance.

2. What happens if I don’t maintain the required minimum balance?

Most banks will charge a penalty of 25 AED per month if your account balance falls below the required amount. CBD is charging AED 105 for not maintaining the balance which is the highest among other best banks in the UAE.

3. Do I need to transfer my salary to my UAE bank account?

It depends up to the account type, if you have opened a salary transfer account, you should transfer your salary every month. if your account is current or saving, you simply need to maintain the minimum balance. If you don’t meet this requirement, you may be subject to a penalty fee.

4. How much do I need to deposit to open an account?

Most banks require 3,000 to 5,000 AED, but some, like Standard Chartered, require up to 10,000 AED.

5. Can a non-resident open a bank account in the UAE?

Yes, non-residents can open accounts, but they are usually limited to savings accounts and may have stricter requirements.

In 2025, the UAE banking sector is a vibrant blend of tradition and innovation. The best banks in UAE continue to lead the industry by offering secure, innovative, and customer-focused financial solutions. They have distinguished themselves not only through their long-standing reputations and robust financial health but also through their commitment to digital transformation and customer-centric service. With a strong emphasis on digital banking and personalized services, the best banks in UAE cater to individuals, businesses, and investors seeking reliable financial partners. Whether it is First Abu Dhabi Bank’s massive scale and stability, Emirates NBD’s forward-thinking digital initiatives, ADCB’s personalized service, Mashreq Bank’s agile innovation, or RAKBANK’s tailored approach for SMEs, each institution plays a unique role in shaping the financial landscape of the region.

As technology continues to reshape every facet of life, the UAE’s banks are rapidly evolving to meet the needs of a diverse and increasingly digital customer base. The best banks in UAE are at the forefront of this transformation, offering advanced digital services and seamless banking experiences. By integrating sustainability, regulatory innovation, and personalized digital experiences, these banks are not only prepared for the challenges of today but are also setting the stage for a resilient financial future.

For consumers and businesses alike, choosing a bank today means selecting a partner that understands modern financial challenges and has the vision to deliver cutting-edge solutions. Whether it’s digital-first banking, wealth management, or SME support, the best banks in UAE provide tailored solutions to meet diverse financial needs specially when it comes to average salaried residents. They continue to redefine industry standards, ensuring that customers enjoy a secure, efficient, and personalized banking experience in an ever-changing global economy.

In summary, the UAE’s banking sector in 2025 showcases how tradition and innovation create a secure, forward-looking financial environment. The Top 10 best banks in UAE excel in digital advancements, strong regulations, and customer-focused services. Whether you need wealth management, digital banking, or everyday transactions, choosing from the best banks in UAE ensures reliability and top-tier service in an evolving global market.

[…] 2025, the Best Banks in UAE offer a range of credit cards designed to fit different lifestyles. Whether you’re interested […]