Establishing an LLC Company in UAE can be a life-changing move for entrepreneurs aiming to penetrate the Middle Eastern markets. The UAE’s robust economy which is rated #1 on the most stable global economies, its strategic location, and investor-friendly policies make it an attractive country for business. This comprehensive guide delves into the intricacies of forming an LLC Company in UAE, providing professionals with detailed insights into the process, legal structures, benefits, and compliance requirements

Introduction to Formation of LLC Company in UAE

An LLC, or Limited Liability Company, is a business structure that combines the flexibility of a partnership with the legal protections of a corporation. LLC Company in UAE is a separate legal entity, meaning the liability of shareholders is limited to their share capital. This structure is particularly appealing to small and medium-sized enterprises (SMEs) due to its balance of operational flexibility and financial security.

The UAE’s location as one of the greatly admired GCC countries and world-class infrastructure make it an ideal destination for LLC formation. However, the process involves navigating a complex regulatory landscape, which requires a thorough understanding of the legal framework, procedural requirements, and strategic considerations.

Ownership Requirements for LLC Company in UAE

Historically, the UAE’s Commercial Companies Law (Federal Law No. 2 of 2015) required that at least 51% of the shares in a mainland LLC Company in UAE be owned by a UAE national or a company wholly owned by UAE nationals. This rule was designed to ensure local participation in the economy. However, in 2020, the UAE introduced significant reforms to attract foreign investment and enhance its business-friendly environment. These reforms, outlined in Cabinet Resolution No. 16 of 2020, allow 100% foreign ownership of mainland LLC Company in UAE in specific sectors and activities. This means that foreign investors can now fully own their businesses in the UAE without the need for a local Emirati partner or sponsor, provided their business activity falls under the approved list. The UAE maintains a “Positive List” of Business Sectors and Activities which fall under the 100% foreign ownership regulation.

Each emirate has its own regulatory authority overseeing business formation, with the Department of Economic Development (DED) being the primary body responsible for issuing licenses, approving company names, and ensuring legal compliance. Depending on the nature of the business, additional approvals may be required from sector-specific regulators.

For up-to-date legislative requirements, consult the UAE Ministry of Economy.

Legal and Structural Aspects of an LLC

An LLC Company in UAE is a widely used corporate structure, allowing Two to Fifty shareholders, with each shareholder’s liability limited to their capital contribution. This structure provides flexibility while ensuring asset protection for investors.

The Memorandum of Association (MOA) is a foundational document that must outline key aspects such as:

- Capital Structure – The total capital invested and its allocation among shareholders.

- Profit Distribution – The agreed mechanism for sharing profits and losses.

- Governance Framework – The rights, responsibilities, and decision-making processes for shareholders and management.

Unlike Free Zone companies, which are restricted to operating within their designated zones unless they appoint a local distributor or obtain special approvals, a mainland LLC Company in UAE can conduct business anywhere in the country without geographical limitations. This makes LLCs a preferred choice for businesses looking to tap into the broader UAE market.

Capital Requirements and Financial Considerations

The UAE has abolished strict minimum capital requirements for LLCs, granting businesses flexibility in determining appropriate capitalization based on their industry and operational needs. However, capital should be sufficient to cover startup costs, ensure financial sustainability, and meet regulatory obligations. While there is no legally mandated amount, industry norms suggest a typical capital deposit ranging from AED 50,000 to AED 300,000, subject to sector-specific regulations.

Additionally, some business activities may require regulatory approval from authorities such as the Central Bank, Securities and Commodities Authority (SCA), or industry-specific regulators before incorporation.

Legal Compliance and Regulations

An LLC Company in UAE must comply with the regulations set forth by the Department of Economic Development in the respective emirate of incorporation. The DED oversees company registration, licensing, and regulatory compliance. Businesses can refer to the official Dubai DED website for guidelines on legal requirements and sector-specific approvals.

For businesses operating in multiple emirates, additional approvals from the Ministry of Economy or the Federal Tax Authority (FTA) may be required, particularly for companies engaging in VAT or corporate tax obligations. By structuring an LLC in line with UAE legal frameworks, businesses can benefit from full foreign ownership in eligible sectors, operational flexibility, and access to one of the region’s most dynamic markets.

Important Steps to be Considered:

- Annual Business License Renewal: An LLC Company in UAE must renew its business licenses annually to remain compliant. This process involves submitting updated lease agreements and other relevant documentation to the Department of Economic Development (DED).

- Value-Added Tax (VAT) Registration: Introduced in 2018, VAT in the UAE is levied at a standard rate of 5%. Businesses must register for VAT if their taxable supplies and imports exceed AED 375,000 in any 12-month period. Voluntary registration is available for those exceeding AED 187,500. Registered businesses must file VAT returns quarterly through the Federal Tax Authority (FTA).

- Corporate Taxation: Since June 2023, businesses earning over AED 375,000 in net profit are subject to a 9% corporate tax. Certain exemptions apply, particularly for qualifying free zone businesses. Further details can be found on the FTA’s corporate tax guidelines.

- Economic Substance Regulations (ESR): Implemented in 2019, ESR requires businesses engaged in relevant activities to demonstrate substantial economic presence in the UAE. Companies must assess their activities against ESR criteria and file notifications and reports to avoid penalties.

- Anti-Money Laundering (AML) and Ultimate Beneficial Ownership (UBO) Compliance: Businesses must comply with AML regulations by implementing internal policies to prevent money laundering and terrorist financing. Additionally, they must maintain accurate records of UBOs and report them to the relevant authorities to enhance transparency. Read about this Federal Law Decree Here.

Strict compliance with these regulations ensures legal continuity and avoids financial or operational penalties.

Also Read: Business Setup in Dubai | How to Start Business in Dubai

The LLC Registration Process

The United Arab Emirates offers a well-defined framework for establishing an LLC Company in UAE, making it one of the most preferred business structures for investors. With full foreign ownership, LLC Company UAE provides a flexible and scalable option for entrepreneurs looking to enter into the UAE market.

1. Defining the Business Activity

Selecting the right business activity is crucial when establishing an LLC Company in UAE, as it determines the type of license, regulatory requirements, and approvals needed. The UAE’s Department of Economic Development (DED) categorizes licenses into three main types:

- Commercial License: For businesses engaged in trading, retail, import-export, and e-commerce.

- Industrial License: Required for manufacturing, assembly, and production activities, often needing environmental and municipal approvals.

- Professional License: For service-based businesses such as consulting, law, healthcare, and engineering, allowing sole proprietors or firms to operate legally.

Certain industries require additional Government approvals:

- Financial services need clearance from the Central Bank of the UAE.

- Stock trading and investments require Securities and Commodities Authority (SCA) approval.

- Healthcare facilities must comply with the Ministry of Health (MOHAP) or emirate-specific health authorities.

- Educational institutions need approval from the Ministry of Education or local regulators like KHDA in Dubai.

Businesses should ensure proper classification and regulatory compliance to avoid delays and legal issues. Consulting business setup specialists can streamline the approval process.

2. Trade Name Registration

In order to start LLC Company in UAE A trade name is a crucial step. For business registration in the UAE, a trade name represents the company’s identity and must comply with strict government regulations. The Department of Economic Development (DED) in each emirate enforces specific naming rules to ensure professionalism and legal compliance. The chosen name must be unique and not identical or too similar to existing registered businesses. It cannot include offensive, religious, or political terms and must avoid abbreviations of personal names. If a business name includes a person’s name, it must be the full legal name, not initials or short forms.

In Order to find a unique name that is not already in use, you can use the Search Business Names service provided by Government.

Similarly, you can search for different business activities which will provide you with a detailed categorizations of “Activity Group” and their License Type.

Certain words, such as “global,” “international,” or industry-specific terms, may require additional approvals and higher fees. Names cannot infringe on existing trademarks, so businesses should conduct a trademark search before registering. Trade names can be reserved online via the DED portal or through the TAMM system in Abu Dhabi. The registration process typically takes a few days, and fees vary depending on the name type and language. Failure to comply with naming regulations can result in delays or rejection of the business license application, making proper verification essential.

To fill Registration and Licensing form Click here

In summary, The Dubai Department of Economic Development provides a range of digital services to streamline business setup, licensing, and regulatory compliance. Through its e-Services portal, entrepreneurs can complete various business-related transactions online, reducing paperwork and processing times.

Key services include:

- Trade Name Registration – Search, reserve, and register a business name in compliance with UAE regulations.

- Business Licensing – Apply for, renew, or modify commercial, industrial, and professional licenses without visiting a DED office.

- Initial Approvals – Obtain government clearance for business activities before completing full registration.

- License Amendments – Update company details, such as ownership changes, trade name modifications, and activity additions.

- Instant License Service – Get a trade license issued within 5 to 10 minutes for select business activities, bypassing lengthy approvals.

The DED e-Services portal ensures fast, transparent, and paperless transactions, making it easier for businesses to operate and expand in Dubai.

Also Read: How to Start E-Commerce Business in UAE | License, Costs & Set-up

3. Obtaining Initial Approval

Before proceeding with formal incorporation, businesses must obtain initial approval from the Department of Economic Development (DED) of the respective emirate. This is a mandatory clearance confirming that the proposed business activity, ownership structure, and trade name comply with UAE regulations. Without this approval, companies cannot move forward with licensing, notarization, or lease registration.

The initial approval process typically includes:

- Verification of Business Activity – Ensuring the selected activity aligns with DED classifications and does not require additional regulatory approvals.

- Trade Name Clearance – Confirming that the chosen name is available and adheres to UAE naming guidelines.

- Ownership and Legal Structure Validation – Assessing whether the business falls under 100% foreign ownership or requires a UAE national sponsor, depending on the industry.

Applications can be submitted online via the DED e-Services portal or at a DED service center. The approval process usually takes 1 to 3 business days, provided all documents are in order. Once granted, businesses can proceed with drafting the Memorandum of Association (MOA), leasing office space, and obtaining final licensing approvals. Any modifications to business activities or ownership structure after initial approval may require re-submission, causing delays.

4. Memorandum of Association (MOA)

The Memorandum of Association (MOA) is a legally binding document that defines the fundamental structure of an LLC Company in UAE. It specifies the ownership distribution among shareholders, their respective capital contributions, management responsibilities, and the mechanism for profit and loss sharing. The MOA serves as the company’s constitutional framework, ensuring that all stakeholders have clearly defined rights and obligations.

Also Read: Spouse Visa UAE: How to Sponsor Family in UAE

Drafting the MOA requires precision, as it must align with UAE commercial laws and the specific business activities of the company. Key clauses typically include decision-making authority, voting rights, transfer of shares, and dispute resolution mechanisms. Any errors or ambiguities in this document can lead to operational and legal complications.

Once finalized, the MOA must be notarized by a UAE Notary Public and submitted to the Department of Economic Development (DED) as part of the company registration process. Amendments to the MOA, such as changes in ownership structure or capital adjustments, require formal legal procedures, including shareholder approvals and additional notarization. These modifications may also necessitate further approvals from regulatory authorities, depending on the nature of the business. Ensuring the accuracy and completeness of the MOA from the outset can prevent delays and legal disputes in the future.

5. Leasing Office Space and Ejari Registration

A physical office address is a mandatory requirement for all mainland LLC Company in UAE, as it establishes the company’s official business location and facilitates regulatory compliance. Every company must lease commercial space that meets the specifications set by the respective emirate’s economic department. This address is used for government correspondence, inspections, and visa processing.

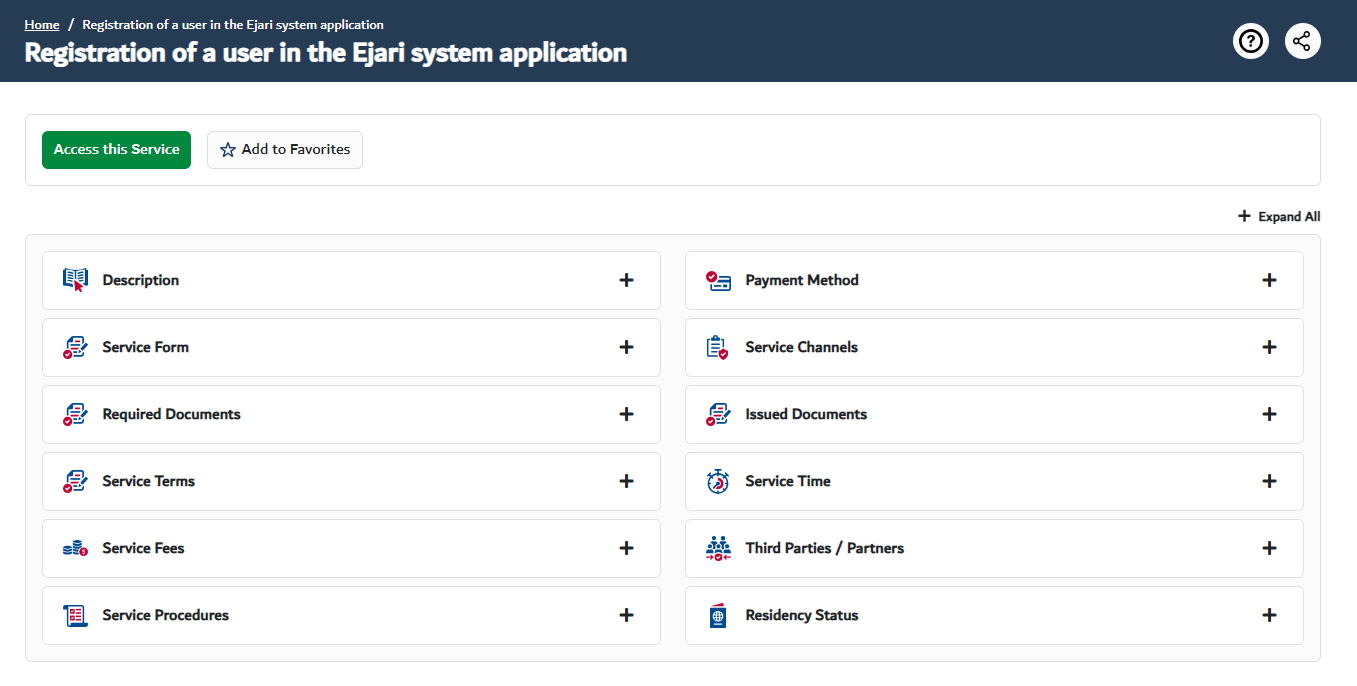

In Dubai, lease agreements must be registered through the Ejari system, which is managed by the Dubai Land Department. Ejari ensures that all rental contracts are legally binding, standardized, and recorded in a centralized database. Without an Ejari-registered lease, businesses cannot proceed with trade license issuance, visa applications, or banking formalities. Other emirates have similar lease registration systems, such as Tawtheeq in Abu Dhabi and Sharjah Municipality’s tenancy contract registration.

The UAE does permit virtual offices address for mainland companies. Businesses must have a physical workspace that meets DED requirements, ensuring legitimacy and accountability. While some business centers offer flexible office solutions, they must still provide a valid lease agreement registered with the authorities. Companies like Servcorp and Regus offer virtual office packages throughout the UAE. Companies should carefully choose office space that aligns with their operational needs and regulatory obligations.

6. License Issuance and Fee Payment

After securing all necessary approvals, completing legal formalities, and registering a physical office, the final step is obtaining the trade license. This involves:

- Application Submission – The completed application, along with all required documents, must be submitted to the Department of Economic Development (DED) of the relevant emirate. Any discrepancies or missing information can result in delays.

- Payment of Government Fees – The cost varies depending on business activity, license type, and additional regulatory requirements. Fees cover trade license issuance, registration, and administrative processing.

- Processing Time – Typically ranges from 7 to 14 days, though straightforward cases may be approved sooner. Delays can occur due to incomplete documentation, trade name conflicts, or additional regulatory approvals required for specific industries.

Once the trade license is issued, an LLC Company in UAE is legally authorized to operate, open corporate bank accounts, sponsor visas for owners and employees, and engage in commercial activities. Businesses must ensure their license is renewed annually to remain compliant and avoid penalties or operational disruptions. Certain industries may require further sector-specific clearances before final approval, making it essential to verify regulatory requirements of an LLC Company in UAE in advance.

Cost Considerations for LLC Company in UAE

The cost of forming an LLC Company in UAE, particularly in Dubai, depends on various factors such as business activity, visa requirements, and office location. While the base cost typically ranges from AED 20,000 to AED 30,000, additional expenses like visa fees and office rent can significantly impact the total investment. The trade name, specific industry regulations, and required services also influence the final cost of creating an LLC Company in UAE. Below is a breakdown of key cost components:

Conclusion: Final Thoughts

Starting an LLC Company in UAE offers businesses a strategic advantage, combining UAE’s economic stability, tax efficiency, and access to international markets. The country’s pro-business policies, modern infrastructure, and expanding trade networks make it an attractive destination for entrepreneurs and corporations looking to scale operations. The UAE’s regulatory landscape has evolved significantly, particularly with reforms that allow 100% foreign ownership. These changes enhance investor confidence and eliminate barriers that previously required local sponsorship for mainland businesses.

Coupled with a transparent legal framework, streamlined business setup procedures, and robust intellectual property protections, the UAE remains one of the most competitive global business hubs. However, while the jurisdiction offers numerous benefits, businesses must remain proactive in complying with corporate regulations. Annual license renewals, tax obligations, including corporate tax and VAT registration, and financial reporting requirements are essential for maintaining legal standing. Additionally, sector-specific regulations, labor laws, and economic substance rules can impact operations, making it crucial for companies to stay informed and seek expert guidance when necessary.

With the UAE’s commitment to fostering a diverse, innovation-driven economy, an LLC structure provides a flexible and secure foundation for businesses to thrive. Entrepreneurs who navigate regulatory requirements effectively will find long-term success in this dynamic and rapidly growing market.